Golden Rules of Accounting

Meaning

Every company must present its financial information to all its stakeholders. Also, the information must be accurate. For this purpose, all the business transactions should be recorded accurately in their respective account. There should be uniformity in account and to maintain it, there are three golden rules of accounting. These rules are the prime necessity to form the very basis of passing journal entries which are further useful in forming the basis of accounting and bookkeeping.

Types of Accounts

In order to keep the record systematically and to understand and apply the golden rules of accounting, accounts are classified into the following three types:

1. Personal Accounts

These accounts are related to a person, firm, company, or institution. Account of Krishna, Account of XYZ Ltd., Account of the University of Delhi, Capital Account or Drawings Account of the Proprietor, etc. are examples of personal accounts.

Objective

A personal account is prepared to know how much amount a personal account owes to the business, i.e., how much amount will be received from him and how much will be paid to him.

Types of Personal Account

Personal accounts can be further divided into three categories which include the following:

- Natural Personal Accounts

These are the accounts of natural persons or human beings. For example, Ram’s Account, Firdaus’ Account, etc. Other than this, Proprietor’s Drawings Account, Proprietors Capital Account, Creditors Account, and Debtors Accounts. - Artificial Personal Accounts

These accounts don’t have physical existence like a human being but they work as personal accounts. For example, firm’s account, institution’s account, limited company’s account, and bank account. Other than these accounts, clubs, insurance companies, and government departments’ accounts are also included in the artificial personal accounts as they also deal in business transactions. - Representatives Personal Accounts

When an account represents a particular person or group of persons then it is called a representative personal account. For example, if the company has not paid the wages of the workers for January, then the amount payable to them will be added to a new account named Wages Outstanding A/c. This account will represent the wages of all workers that are to be payable by the company. Hence, this account will be called a representative personal account. Other examples of these accounts are Accrued Interest Account, Prepaid Insurance Account, Commission Received in Advance Account, etc.

2. Real Accounts

The accounts of all those items which are measurable in terms of money and are treated as the properties of the business are called real account. They include Cash Account, Plant and Machinery Account, Furniture and Fixtures Account, Land and Building Account, Goodwill Account, etc.

Objective

These accounts are prepared to record the value of various properties that are owned by the business in monetary terms and indicate the financial position of the company.

Types of Real Account

Real accounts can be further classified into the following two categories:

- Tangible Real Accounts

The accounts of those items which can be touched, felt, measured, purchased, sold, etc. are known as a tangible real accounts. For example, Cash Account, Stock Account, Furniture Account, Building Account, Land Account, etc. A point should be noted here that the cash account is a tangible real account but a bank account is not. This is because a bank account represents the account of the Banking Company which is an artificial person and hence is termed an Artificial Personal Account. - Intangible Real Accounts

The items which can’t be touched but can be measured, purchased, and sold in terms of money are known as intangible real accounts. For example, Goodwill Account, Trade Marks Account, Patents Account, Copyright Account, Software Account, etc.

3. Nominal Accounts

The accounts of all incomes and expenses are termed nominal accounts. They include income accounts such as commission received, interest received, rent received, discount received, etc., and expenses account such as salaries paid, rent paid, commission paid, bad debts, discount allowed, interest paid on a loan, etc.

Objective

As we know these accounts do not exist in reality, they are just open with the aim of explaining the nature of head for the payment which is done in cash. Without the presence of the nominal account, it will be very difficult for the management to calculate the amount that is paid individually for salary, rent, commission, etc. Nominal accounts give the information about the following:

- Amount spent or expenses done by the business on various heads during a particular period.

- Amount of income received and profit earned by the business on various heads during a particular period.

Note

An important point about the nominal and personal account is that when a prefix or suffix is added to a nominal account then it becomes a personal account or is considered as a personal account. For example:

| Nominal Account | Personal Account |

|---|---|

| 1. Salary A/c | Salaries Prepaid A/c and Outstanding Salaries A/c |

| 2. Interest A/c | Interest Accrued A/c and Interest Outstanding A/c |

| 3. Rent A/c | Prepaid Rent A/c and Outstanding Rent A/c |

| 4. Commission A/c | Commission Received in Advance A/c and Commission Outstanding A/c |

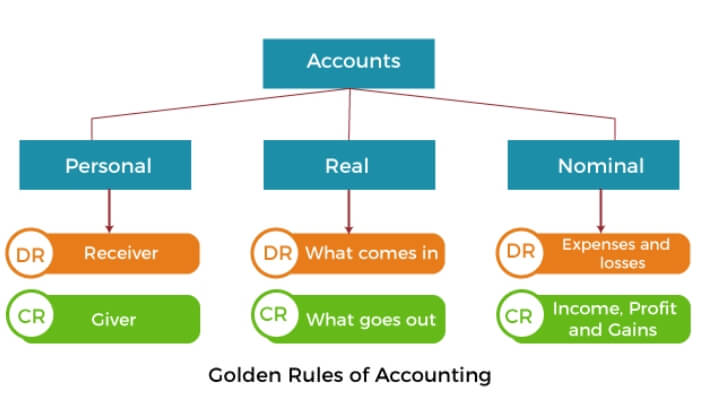

Golden Rules of Accounting

Rule 1: Personal Accounts

The golden rule for recording transactions in personal accounts is ‘Debit the receiver and credit the giver’. As per rule, the person or person’s account who receives something from the business is debited and the person or account who gives something to the business is credited.

Rule 2: Real Accounts

The golden rule for recording transactions in real accounts is ‘Debit what comes in and credit what goes out’. As per this rule, whenever the business receives any property then it will be debited and when it goes, i.e., sold or anything else, it will be credited.

Rule 3: Nominal Accounts

The golden rule for recording transactions in nominal accounts is ‘Debit the expense and losses and credit the incomes and gains’. As per this rule, all those activities of the business which cause an outflow of the cash or cash equivalent, i.e., expenses or losses, are debited while all those activities which cause an inflow of the cash or cash equivalent, i.e., incomes or gains, are credited.