NSE Sensex

NSE or National Stock Exchange is considered as the foremost stock exchange of India (the seventh-largest country in terms of land area). It was established in the year 1992. It is located in Mumbai, the capital city of Maharashtra. The NSE is the second-largest exchange in the world for the cash market trades.

The Managing Director and Chief Executive Officer (CEO) of the National Stock Exchange is Vikram Limaye. He was the CEO and Managing Director of the IDFC (a finance company) before joining NSE. IDFC stands for Infrastructure Development Finance Company Limited.

NSE offers trading facilities to investors all over the country. The investors start with trading in the stock market. Now, let’s discuss the trading and stock market in detail.

Here, we will discuss the following terms:

- Important Terms

- Market Capitalization

- Segments

- History of NSE

- Investment in NSE

- Online Trading

- Trading Schedule

- Order Handling

- Conditions

- BSE

- NSE vs BSE

Important Terms

Let’s discuss some important terms.

Trading

Trading means an act of selling and buying goods and services. In terms of stock, we can say that trading is the act of transferring stock from the seller to the buyer.

The stock is defined as a share that represents the ownership of a portion of a corporation.

Stock Market

The stock represents the collection of sellers and buyers of the stocks. The stock investments are carried out via two platforms called electronic trading and stock brokerages. The electronic trading platform is defined as the online platform, which is generally used to place an order for the financial products using the software. The stock brokerages are the investment broker or a trading representative.

The stock market is also called as the share market. Its goal is to ease the exchange of securities between the buyers and sellers. It ensures that the securities are exchanged at a reduced risk. It helps investors to invest easily rather than investing in large businesses.

The stocks can also be the shares of companies that can be sold and bought on the stock exchanges.

Shares

A company can issue the shares to provide a hike to their investments for future projects. Investors can purchase the stocks of these companies if they believe that they can retrieve the future profit of these companies.

Profit is made when the investors sell the stocks at an increased amount, which can be in the form of capital gain or dividends.

Sensex

Sensex is the term used to determine the measure of the economy of India. Sensex is also known as the sensitivity Index. It represents the stock market index of the financial and established companies. The Sensex of India’s economy has been a growth curve since 1991. The significant growth of the Sensex has to turn out in the 21st century.

Sensex is considered as the benchmark of BSE. Hence, Sensex is commonly used with the term BSE (Bombay Stock Exchange).

Investment

It is defined as the task for funding or investing the money for profit. It is also defined as the process of spending money to receive extra money in the future. The money is invested in various types of cycles.

Investors

The investors sell or buy the stocks through their trading account, which is necessary to invest in the stock market. Investors invest money in various forms in the hope that money will grow over time.

But, investors can also suffer from losses. Hence, an investor should have proper knowledge of investing and where his/her investment could get more profit.

The global investors in NSE include GS Strategic Investments Limited, Aranda Investments Pte Limited (Mauritius), Gagil FDI Limited, etc. The domestic investors include SBI (State Bank of India), Reliance, ICICI Bank, Life Insurance Corporation, IDFC Limited, etc.

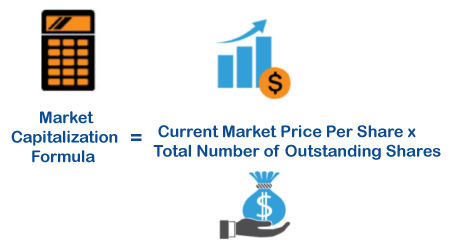

Market Capitalization

NSE Market Capitalization represents the market value of the company’s shares. The total market capitalization of the NSE was $2.27 trillion as of the year 2018. In 2018, NSE was the world’s 11th largest stock exchange. While in the year 2019, NSE was the world’s largest derivative stock exchange by volume. It has traded most of the world’s contract in the year 2019.

Types of Market

Primary Market

The securities of the primary market are determined as initially created stocks. The company shares are sold and offered for the first time. It is a type of open-source market. The company directly sells issued stock in the primary market. It is dominated by large institutes, which can be investment banks, etc.

Secondary Market

The idea of the secondary market is to buy and sell the shares which are owned by the investors. The company that has already sold the stocks cannot be a direct participant in the secondary market transaction.

Let’s first discuss the segments in the stock market.

Segments are defined as the group of people that shares some characteristics for marketing. Such people can be businesses, families, individuals, organizations, etc. The markets are divided into segments for the convenience of the people; Each segment has its lifestyle, needs, demographics, etc. of the customer. The professional marketers approach the segments after understanding it.

The National Stock Exchange offers Investment and trading in various segments, which are listed below:

- Capital Market

- Derivatives Segment

- Debt Segment

Capital Market

The Capital Market segment is further categorized as:

- Mutual Fund

It is a type of investment that is made by collecting funds from various investors. The purpose is to invest these funds in securities, such as money market instruments, stocks, and other assets. - IPO

IPO or Initial Public Offering is considered as the largest source of funds for a company. It sells securities to the public is the main market. - Exchange-Traded Funds

Exchange-Traded Funds or ETFs can be sold all over the trading day like any other stocks. The annual changes and transactions costs of Exchange Traded Funds are lower as compared to index funds. It is considered a safe segment for first-time investors who wants returns linked to the market. - Security Lending and Borrowing

The selling of stock (not own to the seller) can be done by borrowing the stock through the Clearing House. The Clearing House or Clearing Corporation is approved as Intermediaries. - Equities

The securities have two independent segments called primary and secondary segments. The primary segment is also called a new issues market, which provides a channel for selling and developing the new securities. The secondary segment is called the stock market, which deals in previously issued securities. - Indices

Indices or stock market index is defined as a value of stocks in the numerical terms. The value of the index changes when the stocks in a group within the index changes. It is a measure to determine the performance of the investments.

Derivatives Segment

The Derivatives segment is further categorized as:

- Currency Derivatives Segment

The currency future segment is defined as a contract to exchange the currency from another currency on a particular future date at a fixed price decided on the date of purchase or exchange. - Interest Rate future

The Interest Rate future is a contract that ensures to sell or buy the debt instrument on a particular future date at a fixed price of today. - Equity Derivatives

The value of equity derivates is partly derived from one or more of its securities. It commonly shows the daily activities of the equity derivatives segment on the National Stock Exchange. - Commodity Derivatives

The commodity derivatives provide the indicator and analytical information of the market sentiments. It was launched on 12 October 2018. The usage of suitable hedging in the products of commodity derivatives can create a positive impact on business performance.

F & O

The future and Options are the two products of the derivatives. It provides trading in the derivatives instruments, such as Stock Options, Stock Futures, Index Options, and Index Futures.

Debt Segment

The Debt segment is further categorized as:

- Corporate Bonds

Corporate bonds are defined as the debt securities that are generally issued by the companies. The companies can be public or private corporations, which issues a corporate bond to raise money for different purposes, such as purchasing equipment, growing the business, etc. - WDM

The WDM or Wholesale Debt Market is the Exchange segment that started its operation on 30 June, 1994. The WDM is considered as the first screen-based trading facility. It is the formal facility for the debt market in India.

History of NSE

NSE allows trading to the people who were experienced, qualified, and met the minimum financial requirements.

- NSE was established in the year 1992 to bring exposures to the market for India.

- NSE separated its management and ownership under the supervision of SEBI (Securities and Exchange Board of India). SEBI is the regulator of the market, which is owned by the Government of India.

- Initially, Stock price information could be accessed only by a few. But now, it can be easily seen by the clients in a remote location.

- It was a paper-based settlement, which was further updated to electronic-based systems.

- NSE ensures that the electronic-based system also guarantees the protection of the investors against the defaults of the firm or broker.

- The shareholding comprises of the global and domestic investors. Such diverse shareholding was based on the recommendations of the Pherwani Community (an expert group of the stock exchange).

- The tax-paying company was recognized as the stock exchange company in the year 1993. During this time, Manmohan Singh was the Finance Minister, and P.V Narasimha Rao was the Prime Minister.

- In June 1994, the NSE started its operation in the WDM segment. WDM or Wholesale Debt Market deals in fixed income securities.

- NSE started its operation in the equities or capital market and derivative segment in November 1994 and June 2000.

- It also offers a settlement and trading services in other segments, such as debt, currency derivatives, commodity derivatives, equity, and equity derivative.

- The investors worldwide are connected through the electronic-based settlement, which was the first settlement exchange in India.

- NSE consists of the 3000 leased lines and 2500 VSATs across 2000 cities all over India. VSAT or Very Small Aperture Terminal is a data transmission technology, which is used for high-frequency trading and various data management.

- The investors of NSE can easily transfer and hold their shares electronically through NSDL, which is a secure transmission. NSDL stands for National Securities Depository Limited, is a first electronic based security depository.

- The electronic-based settlements eliminated the use of paper, fraud documents, fake certificates that may have an adverse impact on the Indian stock market.

It has also increased the attraction of domestic and international investors in the NSE or Indian Stock Market.

Investment in NSE

Investments are very important today for every stage, such as education, wedding, retirement, etc. So, it’s essential to know about the investment process at the right place. The money you earn is not only for spending. Everyone saves money for future needs. An investment gives a financial gain to the investors.

Here, you will read all the essential points and doubts that are crucial for any investor.

Let’s start.

Why Investment?

The investment lets your money grow over time. Let’s discuss some reasons to make investments, which are listed below:

- Your funds will increase over time that is idle otherwise.

- Investments can be made into different products according to your future goals.

- It is generally a method to secure our future.

Types

Let’s consider the types of investments in which you can invest. It is listed below:

- Financial Assets

- Physical Assets

Financial Assets

These assets include provident or pension funds, insurance, fixed deposits with banks, a small saving instrument with post offices, etc.

Physical Assets

These assets include commodities, such as gold, jewellery, real estate, etc.

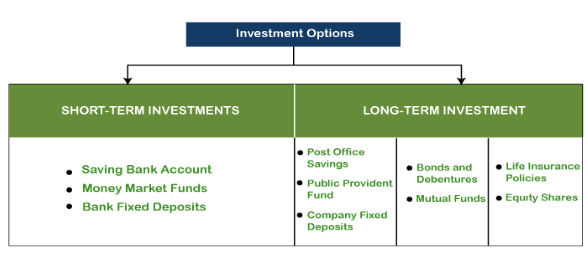

Options

The investment options are shown in the below diagram:

Golden Rules

There are three golden rules for the investors to invest in the National Stock Exchange, which is listed below:

- Invest early

- Invest for the long term

- Invest regularly

The returns and wealth of investment take time. An investor should have patience.

When you invest early, you are giving a lot of time for your investment to increase.

Points to understand before Investing

Investments are suitable if invested in the right place. So, let’s consider some points that everyone should know before investing.

- Ask for the written documents that adequately explains the investment.

- Read the documents carefully.

- Verification of the legitimacy of the investment

- Assessment of the returns and the risk factors associated with it

- Find out the advantages and disadvantages of investment.

- Compare it to make an investment.

- Be aware of its safety aspects.

- Compare the investment with other investments.

- Explore if it fits your current and future portfolio.

- Make an authorized deal before investing.

- Clarify all your doubts without any hesitation. Do not invest if you are not satisfied.

Investment in NSE

To begin investing, a person requires the following documents, which are given below:

Trading Account

The trading account acts as a bridge between the bank account and the Demat account. The trading account and Demat account are created together.

The required documents to open a Trading account are listed below:

- PAN (Permanent Account Number) card photocopy

- Passport-sized photographs

- Any identity proof, such as Aadhaar card, driving license, Voter-ID card, etc.

- Any address proof, such as driving license, passport, voter-ID card, domicile, etc.

Demat Account

The Demat account is used to hold your securities digitally. To open a Demat account, we need the following documents:

- PAN card photocopy

- Passport-sized photographs

- Any identity proof, such as Aadhaar card, Voter-ID card, etc.

- Any address proof, such as driving license, passport, voter-ID card, domicile, etc.

After the verification of all these documents, your Demat account is created.

KYC Form

The KYC or Know Your Client is the agreement between the investor and the broker. Form is common for all the types of investments registered at the stock exchange.

The KYC form includes some regulations, which are listed below:

- The forms are different for the individual and non-individual type of investors.

- Never sign any empty form.

- Cross-check left blank pages.

- Recheck the documents that you need to submit.

The documents required for the KYC form are listed below:

- PAN card photocopy

- Passport-sized photographs

- Any identity proof, such as Aadhaar card, Voter-ID card, etc.

- Any address proof, such as driving license, passport, voter-ID card, domicile, ration card, bank passbook, etc.

Let’s start with the investment process of the National Stock Exchange.

Stock Broker

The stockbrokers are called the registered member of the stock exchange, which trades on behalf of the investors. It means that the investors can buy or sell the stock directly. The stockbrokers can also be employed at a broker’s firm or an independent broker. They can help you in making the right decisions.

You might be thinking about what a stockbroker can do. So, let’s discuss this.

- Stockbrokers can sell or buy stocks.

- They have good knowledge about the stock market. So, they can guide you to the stock market.

- They can be your representative in the stock market.

- They will inform you about all the market updates.

- The stockbrokers will provide you with the correct information about the shares and their prices.

But, you can also approach the SEBI Registered member instead of a broker.

In case you are not satisfied with the broker, you can file a complaint with the SEBI (Securities and Exchange Board of India) under the Arbitration Laws.

The steps to start investing are listed below:

- You should have trading, Demat, and a bank account. Some larger banks, such as ICICI, and HDFC provides a three-in-one account, where all are linked to each other.

- You need to go to the stockbroker, where they will guide you about the opening of the account to the investment.

- You can also opt for two entities called NSDL (National Securities Depositary) and CDSL (Central Depositary Services) to open and maintain the Demat accounts. These entities are mandated to be the custodian of the dematerialized securities.

- Some big stockbrokers can also be the registered Depositary Participant. They act as an agent to provide the services to the investors.

Online Trading

In January 2000, SEBI approved the brought of Internet-based services and trading, which takes place through the routing systems. The routers will route the orders of the clients to exchange the trading system. The client can access trade sitting in any part of the world through the Internet with brokers’ help. The broker acts as the medium that introduces you to the Internet-based trading.

NSE is considered the first stock exchange to approve online trading, which provides Internet-based trading services. The circular has been issued by the NSE that explains the guidelines and procedures is the circular number NSE/MSD/41332, which is dated 17 June, 2019.

The NSE members can also utilize the services provided by the ASP, which includes software and hardware maintenance. The circular issued by the NSE explaining the ASPs () requirements is the circular number SE/CMO/0028/2000, which is dated 18 December, 2000.

Trading Schedule of NSE

The trading on the equities segment takes place on the days except for the Saturday, Sunday, and other holidays declared by the exchange in advance.

The trade timings for the equities segment are listed below:

1. Timings for Pre-Open session

Open timings for order entry and modification are: 09:00 Hrs

Close timings for order entry and modification are: 09:08 Hrs

Pre-Open immediately starts after the Pre-close timings.

2. Timings for Regular Trading session

Open timings for Normal/Limited Physical Market are: 09:15 Hrs

Close timings for Normal/Limited Physical Market are: 15:30 Hrs

The timings for Block Deal Sessions are listed below:

The morning window of Block Deal Session operated between 08:45 AM to 09:00 AM.

The afternoon window of Block Deal Session operated between 02:05 PM to 02:20 PM

A Block deal is when two parties agreed to buy or sell the securities at the agreed price, which is further informed to the stock exchange on the special window. The minimum value of the deal can be Rs. 5 crores.

3. The timing duration for the closing session is held between 15:40 hrs and 16:00 hrs.

Orders Handling

The orders are classified as the best buy order and best sell order. The best buy order is the order with the highest price, while the best sell order is the order with the lowest price. A seller always wants to sell the product at the highest offered buy price. It depends on how the computer views the order.

The computers view the entire sell and buy orders from the point of view of the buyers and the sellers.

Conditions

A member of a trading system can specify types of orders as per his/her requirements. It is further classified based on two categories, which are listed below:

- Time Conditions

The time conditions are categorized based on:

DAY: As the name suggests, the order is only valid for the day on which it is specified or entered. The orders are matched with other orders in the trading system. If the order does not match on a particular day, it automatically gets cancelled at the end.

IOC: Immediate Or Cancel is the condition in which the order needs to match instantly when it is entered. It means that the trading member has to sell or buy security immediately when it is released. Otherwise, the order will be deleted from the market. A partial match can work in such cases, but the unmatched part of the order suddenly gets cancelled.

- Price Conditions

Some of the essential price conditions are listed below:

- The order placed by the trading member only gets activated when the market price of the order is greater or equal than the threshold price. It is called the Stop Loss (SL) Price / Order.

- For example,

Let the limit price of the order be: 70

The market price be: 75

The trigger price be: 73

The order is released in the system when the value of the market price becomes equal or greater than 73.

BSE

The BSE or Bombay Stock Exchange is determined as the pulse of domestic stock markets in India. The stock market index of BSE consists of the list of 30 well-renowned and financial companies. Some of the traded stocks of these 30 companies are the largest and active stocks.

NSE vs. BSE

Let’s discuss some differences between NSE and BSE.

| NSE | BSE |

|---|---|

| NSE stands for National Stock Exchange. | BSE stands for Bombay Stock Change. |

| It is the Stock Exchange across the nation. | It is the Mumbai-based Stock Exchange. |

| It is the biggest stock exchange in India. | It is considered as the oldest stock exchange in India. |

| NSE was established in 1992. | BSE was established in 1875. |

| Nifty is considered as the benchmark of the NSE. | Sensex is considered as the benchmark of BSE. |

| The volume of share trading in NSE is high. | The volume of share trading in BSE is low compared to NSE. |

| The Managing Director and Chief Executive Officer (CEO) of NSE is Vikram Limaye. | The Managing Director and Chief Executive Officer (CEO) of BSE is Ashish Kumar Chauhan. |