Difference between Money market and Capital market

The money market and Capital market both belong to the financial market. Although both involve investments and the flow of money, they are different from each other. Money markets involve short-term loans or borrowing; generally, the assets are detained for one year or less. However, Capital Markets involve long-term investments like buying stocks and bonds by financial institutional, brokers or common investors.

Money market

The money market is a feature of the economy that offers short-term investment options. The money market trades in short-range loans, usually for a year or a smaller period or even less than a day.

There are numerous money market tools that are used in the money market related to counting treasury bills, commercial paper, banker’s receipts, deposits, certificates of deposit, bills of trade, repurchase concurrences, federal funds, etc. These tools handle conflicting maturities, money, credit dangers, and compositions. So, a market can be called a money market if it mainly deals with short-range assets. Money markets, which offer liquidity for the worldwide financial structure and capital markets, are elements of the broader financial market method.

The money market helps the financial market mainly in five different ways that are financing deals, financing industry, makes investment profitable, enhances commercial banks’ self-reliance, and assists central bank policies. Some of the major benefits of the money market are described below;

- Money market investors usually invest in administration securities, certificates of deposit, commercial papers of corporations, and other less-risky securities.

- The money market contains financial associationsand traders in money or credit who desire to borrow or lend. Members borrow and lend for short times, generally up to or less than one year. The money market remains focused on interbank lending in which banks borrow and gives loans to one and another with the help of commercial paper, repurchase agreements, and related tools. Finance companies usually fund themselves by permitting a massive quantity of asset-backed commercial paper (ABCP), protected by the pledge of suitable assets, into an ABCP instrument.

- The money market has a fundamental role in financing local and international trade. The money market allows commercial banks to use their additional funds in gainful investments. The primary purpose of commercial banks is to make income from their funds and keep liquidity to gather the unsure cash order of its depositors. When an emergency occurs commercial banks can fulfil their necessities by using their previous short-run loans from the money market.

- Although the central bankcan work and persuade the banking system in the lack of a money market, the survival of a developed money market smoothes the functioning and strengthen the central bank’s capability.

Capital market

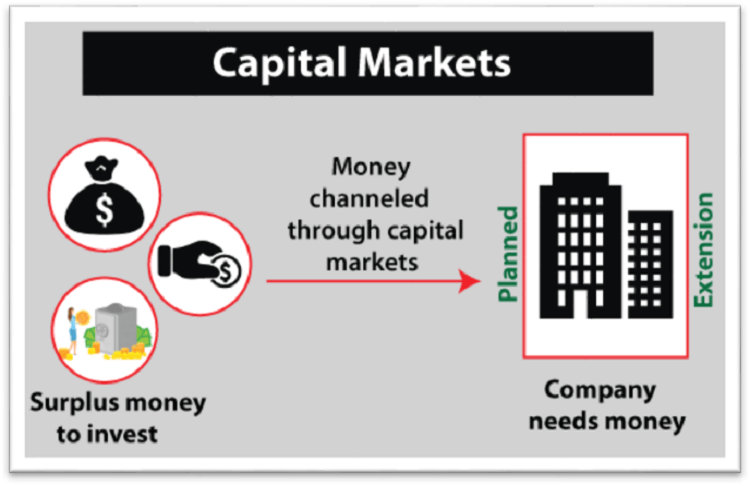

A capital market is a part of the financial market in which long-term debt or equity-supported securities are purchased and sold, unlike a money market which involves buying and selling of short-term debt. Capital markets channel investors’ money to those who can use it for the long-term like corporations or governments creating long-term investments.

Financial supervisors such as the Securities and Exchange Board of India (SEBI), Bank of England (BoE), and the U.S. Securities and Exchange Commission (SEC) supervise capital markets to safeguard the interests of the shareholder. Bodies usually supervise dealings on capital markets within the financial segment or the treasury sections of administrations and corporations, but some can be admittances openly by the public.

Many private companies use online hypertext- based stages that allow customers to buy or invest in the market easily. Many banks and governments of countries like London, New York, and Hong Kong etc., are using the capital market as their secure and profitable option for debt or investments for years.

The most main traders in capital markets are governments and dealing companies. Governments generally publish bonds, while corporations generally publish mutual equity and bonds. The most popular investment in the capital market are bonds, stocks, pension funds, hedge funds, sovereign wealth funds, and some rich people and investment banks also trade for themselves.

Regular bank loans are generally not counted in a capital market deal though loans are given for more than a year. Most importantly, usual bank loans are not protected. On the other hand, loan from banks is more seriously synchronized than capital market lending.

When a company plans to raise money for long-term investments, it mostly does so by permitting bonds or shares. Equally, bonds are safer if the company does not look good, as they are less prone to sharp falls in price. Finally, in the occasion of bankruptcy, bond owners may be salaried rather, while shareholders will not gain anything.

Types of capital market

There are two main types of capital markets;

Primary market: A primary market is a place where dealers trade with new securities or share. In this market, the company takes cash from an investor or buyer and offer new securities or any other instrument in exchange.

Secondary market: Secondary market deals with formerly issued or existing shares. Every security can be sold on the primary market only once but can be resold again in the secondary market. Although, Dealings on the secondary market do not openly support finance. Still, they make it easier for companies and governments to withdraw money from the primary market, as shareholders know that if they wish to get their money back fast, they will generally be easily capable of re-selling their securities. There is no limit to how many times a security can be sold in the secondary market. Also, the secondary market divides the security on the basis of what nature they are, for example, it belongs to the stock market or bond market.

Difference between money market and capital market

The main difference between the money market and the finance market is of the time period as Money market lends for a short period but Capital Market works for a long term lending. There major differences between them are given below;

| Basis of comparison | Money market | Capital market |

|---|---|---|

| Definition | Money market is a place where we invest for the short term on instruments like trade credit, commercial paper, certificate of deposit, treasury bills etc. | Capital Market is a type of financial market in which the company or government securities invest for the long term in the instruments such as bonds, stocks, etc. |

| Nature | Money markets are casual in nature. | Capital markets are formal or official. It is known for dealing in mutual stocks and bonds. |

| Instruments | Commercial Papers, Treasury certificates of deposits, Bills, Trade Credit, etc., are included in the money market. | Bonds, Debentures, splits, Asset Secularization, Retained Earnings, Euro Issues, etc., are included in the capital market. |

| Types of investors | Commercial banks, non-financial institutions, central banks, chit funds, etc., are the primary investor types. | Stockbrokers, insurance companies, Commercial banks, underwriters, etc., are the primary investor types. |

| Liquidity of market | Money markets are incredibly fluid. | Capital markets are relatively more minor liquid. |

| Security | Money markets have low risk. | Capital markets have a significant risk in comparison to money markets. |

| Time | Instrument matures in a year. | Instruments take much time to get mature. |