What is Share Market?

A share market is a platform where a large number of buyers and sellers come together to trade on publicly listed shares. The financial activities in the share market are conducted via institutionalized formal exchanges or over-the-counter (OTC) markets. These activities are done under a defined set of rules and regulations formed by SEBI, the apex institution of the capital market. The share market is a large pool of funds and securities. It creates a bridge between the deficit (issuers) and surplus (investors) parties. This all makes the share markets a vital component of the free-market economy.

Features/Functions/Importance of Share Market

Some of the prime features and importance of the share market are as follows:

- Economic Barometer

Share market covers a major segment of the financial system of the country. Hence, it works as a reliable barometer to determine the economic condition of the nation. The prices of shares reflect every major change in the country’s economy and other conditions. The rise and fall in prices of shares indicate the boom and recession in the economy. That’s why the share market is called the pulse of the economy or economic mirror. - Pricing of Securities

The share market forces of demand and supply help the companies in deciding the prices of their securities. The demand for shares is higher for profitable and growth-oriented companies and hence the prices of their shares are also higher. The valuation of securities is useful for various parties such as investors (for analyzing the profitable investment), the government (for imposing taxes on the value of securities), and creditors (for determining the creditworthiness of the company). - Safety of Transactions

In the share market only the listed companies can issue their shares under the complete regulation of SEBI. The exchange authorities include the companies only after verifying their soundness. These companies issue the shares within the strict rules and regulations formed by SEBI. This all ensures the safety of transactions. - Contributes to Economic Growth and Development

In the share market, various companies issue their securities to investors. This process of disinvestment and reinvestment helps in channelizing the funds for more effective use which is further beneficial for the capital formation of the companies. This increases the production of the business which increases the demand for labor (generation of employment opportunities), demand for goods and services, national income, and improves the standard of living. This is a circular process that supports economic growth and development. - Spreading of Equity Cult

By regulating new issues, better and easy trading practices, and making people aware of investment, the share market encourages people to invest in ownership securities. - Providing Scope for Speculation

The share market gives the permission for healthy and legal speculation of securities to make more liquidity and demand and supply of securities. - Liquidity

The share market has the function of providing a ready market for the trading of securities. The market assures the investors for the conversion of shares into cash as and when required. Because of this, the investors can invest their funds in long-term securities without any hesitation as these securities can be converted into cash very easily. The securities can also be used by the shareholders as a medium of exchange of goods and services. - Better Allocation of Capital

It is easy for profit-making companies to raise fresh capital from the market due to the higher demand for their shares. By investing in such companies, the investors can earn higher returns rather than investing in a loss-making company or a company with lower returns. This supports the better allocation of investors’ funds. - Promotes the Habit of Savings and Investments

The investors get so many attractive and profitable investment opportunities in the share market. These opportunities encourage them to save and invest more into the securities instead of investing the funds into unproductive assets such as gold, silver, etc. This investment is further beneficial to the development of the nation.

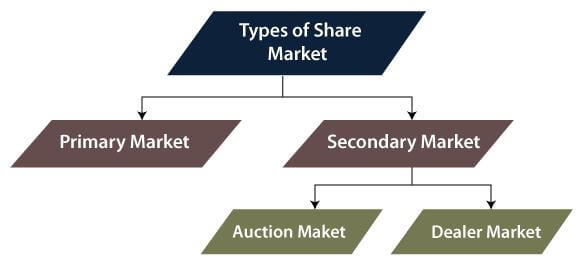

Types of Share Market

The share market has the following two categories:

1. Primary Market

The primary market is the place where the companies issue their shares for the first time to the general public. In this market, the securities are created. Here, the issue can be done through private as well as public placement. An IPO is an example or instrument of a primary market. IPO starts the initial underwriting for a particular stock. After issuing the IPO the company gets listed on the stock exchange and has the right to issue its shares in the secondary market.

2. Secondary Market

The secondary market is the place where securities are traded. This market is often referred to as the “stock market”. Here, the investors buy and sell the previously issued shares without any involvement of issuing company. This market is operated through the counter and exchange-traded market. The secondary market can be divided into two categories:

- Auction Market

An auction market is an exchange-traded market. In this market, all interested investors congregate in one area and announce the price at which they can buy or sell the shares. These are called the bid and ask prices. It is the same as the auction of any other asset. - Dealer Market

The participants in the dealer market are not physically linked with each other. Rather, they are connected via electronic networks. The dealer has an inventory of shares and he/she trade them with market participants. The source of earnings of these dealers is the margin between the buying and selling prices of securities.

Participants in Share Market

There are five main participants in the share market including:

- Security Exchange Board of India (SEBI): As a regulatory body.

- The Stock Exchanges: As a medium for the trading of shares.

- Public Listed Companies: As the issuer of shares.

- Investors and Traders: As buyers of shares.

- Market Intermediaries: As a link between issuer and investors or deficit and surplus party.

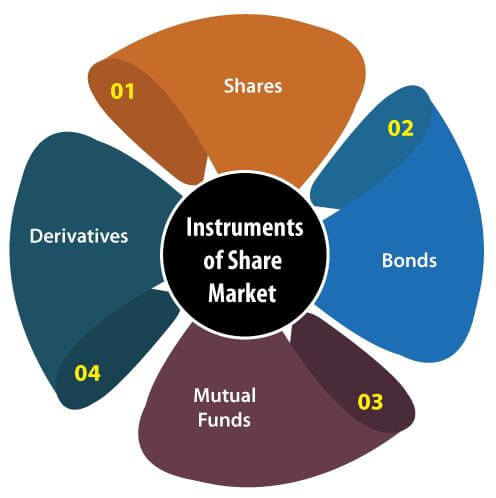

Instruments of Share Market

There are generally four instruments that are traded in a share market. They include:

1. Shares

A share shows a unit of equity ownership in an enterprise. Shareholders have the right to enjoy the company’s profit in the form of dividends. But along with the profits, the shareholders are also the bearer of any loss faced by the company.

2. Bonds

A company may need substantial capital to invest in long-term and profitable projects. Bonds are one of the best options in such a case to raise capital from the public. Bonds are a type of long-term loan for the company. The bondholders get timely interest payments from the organization in the form of coupons. For the bondholders, these coupons are the fixed source of their income where they enjoy the interest on their investment and the invested amount at the end of the loan period.

3. Mutual Funds

Mutual funds are the pool of professionally managed funds of different investors which are further invested into various profitable financial securities. Mutual funds are available for various securities like equity, debt, hybrid funds, etc. Mutual funds issue the units to the investors which have an almost equal value to a share. When an investor invests in a mutual funds scheme then he/she becomes a unitholder. The unitholders also get dividends when the company (in which the funds were invested by the mutual funds) earns revenue.

4. Derivatives

A derivative is a security whose value is derived from an underlying security. These underlying securities can be shares, bonds, commodities, currency, gold, forex rates, treasury bills, etc. Some types of derivatives are forward, future, options, warrants, SWAP, and Swaptions.

Securities and Exchange Board of India (SEBI)

SEBI is the regulatory body for securities and commodity markets in the country under the ownership of the Ministry of Finance, GoI. The board was established on 12 April 1988 but it got the statutory powers on 30 January 1992 under the SEBI Act, 1992. Complete share market work under the rules and regulations of SEBI. It is the apex institution in the capital market.

Some of the powers of SEBI are as follows:

- SEBI has the power to regulate:

- Depositories and participants

- Merchant bankers

- Custodians

- Venture capital funds

- Debenture trustees

- Underwriters

- Mutual funds

- Portfolio managers and investment advertisers

- Bankers to issues

- FIIs

- Insider trading

- Stockbrokers

- Substantial acquisition of shares

- Others

- SEBI can issue guidelines related to:

- Development of financial institutions

- Bonus issues

- Preferential issues

- Firm allotment and transfer of shares among promoters

- Pricing of issues

- Financial instruments

- Information disclosure and investor protection

Drawbacks of Share Market

Various drawbacks or limitations of the share markets are as follows:

- Risk

There is a high risk in the investment done in the share market. There is a possibility of losing the entire investment. Even if the investor sells the stock then he/she can lose the initial investment. Also, there is not any fixed and regular return for the common shareholders. - Common Shareholders Paid Last

Bondholders and preference shareholders get the dividend and their money return (at the time of wind up) first but the common shareholders do not get this benefit. They get paid last in both cases if the profits are left after paying the bondholders and preference shareholders. - Time Consuming

It is highly time-consuming to find a company that can give the maximum return on your investment. You have to conduct proper research by checking the financial statements and annual reports of different companies. You have to be active in the stock market and wait for the market crash, market correction, or bear market so that the prices of the best companies can get reduced. - Taxes

You can face a tax break if you are selling your shares for a loss. However, if you are earning a profit on your sale then you will have to pay capital gains taxes. - Professional Competition

The general public gets huge competition from institutional investors and professional traders. They have more knowledge and time to invest in the market. They have the availability of sophisticated trading tools, computer systems, and financial models at their disposal which makes access to the market difficult for the general public.

How to Diversify to Lower Investment Risk?

A shareholder is at higher risk in comparison to a bondholder. But as a shareholder, you can reduce this risk by diversifying. Diversification refers to the practice of investing in different types of assets among different companies of different sectors so that the risk can spread. In such a case if one type of asset is bearing loss then you can earn profit from the other investments. It is also called portfolio diversification.

Here are some ways to diversify your portfolio or risk:

- Investment Type

Stock ownership is highly riskier than a well-diversified portfolio. A mix of stocks, bonds, and commodities in your investment will provide more benefits and higher returns with lower risk. - Company Size

There are different sized companies as per their capitalization such as large-cap, mid-cap, and small-cap. Investors should invest in different-sized companies because their performance is different in each phase of the business cycle. Small-cap companies have great growth potential but are more susceptible to share price volatility while large-cap companies are not. - Location

You can involve the companies in your portfolio as per their geographic location. This is because the geographic conditions also affect the business of the company. So it is a better way to invest in emerging markets to enjoy the benefits of growth without being vulnerable to any single geography. - Mutual Funds and ETFs

Mutual Funds or Exchange-Traded Funds (ETFs) give the advantage of owning hundreds of stocks selected by the fund manager. So, it is also a good option to invest your funds in mutual funds or ETFs and get the return earned on the investment done by them. Index funds or index ETFs can also be used to diversify the investment.