Statutory & Taxation in Tally ERP 9

In Tally, the features of statutory and taxation consist of configuration and functions related to statutory compliance for company. The features of statutory are related to country-specific and depend upon the country.

The following features are available for statutory and taxation:

- Goods and Service Tax (GST)

- Excise

- Value Added Tax (VAT)

- Tax deducted at Source (TDS)

- Tax collected at source

In India, Tally supports various taxations, including GST.

How to enable Statutory & Taxation Features

In Tally, we can use the features of Statutory and Taxation by enabling and disabling the option in the company alteration screen.

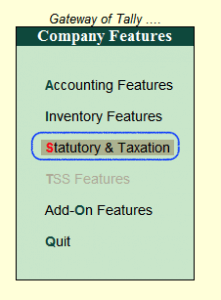

We will use the following path and open the statutory and taxation:

Gateway of Tally -> F11: Features -> Company Features -> Statutory Taxation

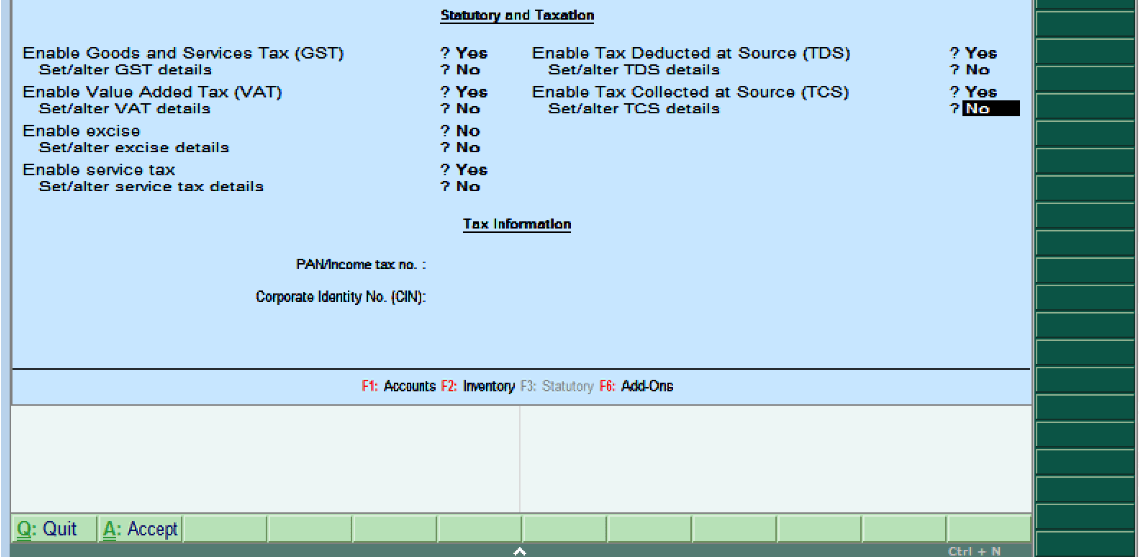

Update the following details on Company Operations Alteration Screen:

Enable Goods and Services Tax (GST): If we want to use GST tax for company, enable GST option

Set/alter GST details: If we want to change the GST detail, enable this option.

Enable Value Added Tax (Vat): Now India is following GST tax, so disable this option as GST tax is followed by Company.

Set/Alter VAT details: If we want to select No, choose this option.

Enable Excise: If we want to use the Excise, enable this option

Set/alter excise details: If we want to change the excise details, enable this option

Enable Service Tax: If we want to use the service tax by company, enable this option

Set/alter service tax details: If we want to alter the service tax details, enable this option

Enable Tax deduction at source: If we want to use TDS, enable this option

Set/alter TDA details

Enable Tax collected at Source: If we want to use TCS, enable this option

Set/alter TCS details

Tax Information:

Income/PAN Tax No: Update the company permanent Income tax number or account number in this field.

Corporate Identify No: Update the CIN number of company in this field.

In Tally ERP 9, after updating all the required details for statutory and taxation, choose A: Accept to save the details.